Debt consolidation is the process of merging multiple debts, like loans or credit cards, into a single monthly debt payment. This method of debt refinancing typically involves taking out a new loan, with the ultimate goal of saving the borrower time and money.

In this article, you’ll learn:

- Benefits of Debt Consolidation

- How does debt consolidation work?

- Examples of Debt Consolidation

- Types of Debt Consolidation

- Is debt consolidation a good idea?

- Debt Consolidation Requirements

- How much can I save by consolidating my debts?

- When debt consolidation is not a smart move?

- Debt consolidation pros and cons

- How to choose the right debt consolidation company

- Debt Consolidation Alternatives

- Making the Most of Debt Consolidation

Benefits of Debt Consolidation

There are many benefits of debt consolidation, including:

- Saving money: The biggest perk of debt consolidation for most people is saving money. You can save significant money in interest by consolidating multiple high-interest debts into a single lower-interest loan or credit card.

- Simplifying payments: Managing multiple debt payments each month can be a challenge. And it can lead to late or missed payments, which negatively impact your credit score. Streamlining multiple monthly payments into one makes managing debt much easier and can help boost your credit score.

- Well-defined repayment term: Some debts, especially credit cards that aren’t on a fixed payment schedule, can linger for years until you pay them off. But the right debt consolidation loan will put debt repayment on a fixed schedule. That means you’ll know down to the day when your loan will be repaid in full.

- Less stress: Managing one debt instead of many can remove many stressful financial interactions each month. Plus, knowing you’ve locked in a lower interest rate and will be saving money can reduce stress too.

How does debt consolidation work?

Debt consolidation works by taking out a single loan to pay off multiple existing debts. Once the debt consolidation loan is approved, you’ll use the money to pay off other lenders, then work to aggressively pay back the new loan instead.

Related Article: How to consolidate debt?

Examples of Debt Consolidation

Let’s say you currently have debt on two credit cards and a personal loan. Between these three items, you’re holding $25,000 in debt and are paying 21.99% interest that’s compounded monthly.

To become debt-free, you’ll be paying $750 a month for 52 months. And you’d be paying a whopping $13,987 in interest.

Now assume you consolidated those debts into a single debt consolidation loan at 10% interest also compounded monthly. To bring the balance of that loan down to zero, you’ll be paying $806 a month for only 36 months. But now, only $4,040 of that is in interest.

What this means is by taking out a debt consolidation loan, you could save $9,947 with only a slightly higher monthly payment. But it’s important to keep in mind that you may also have some fees associated with a debt consolidation loan that could eat into those savings just a bit.

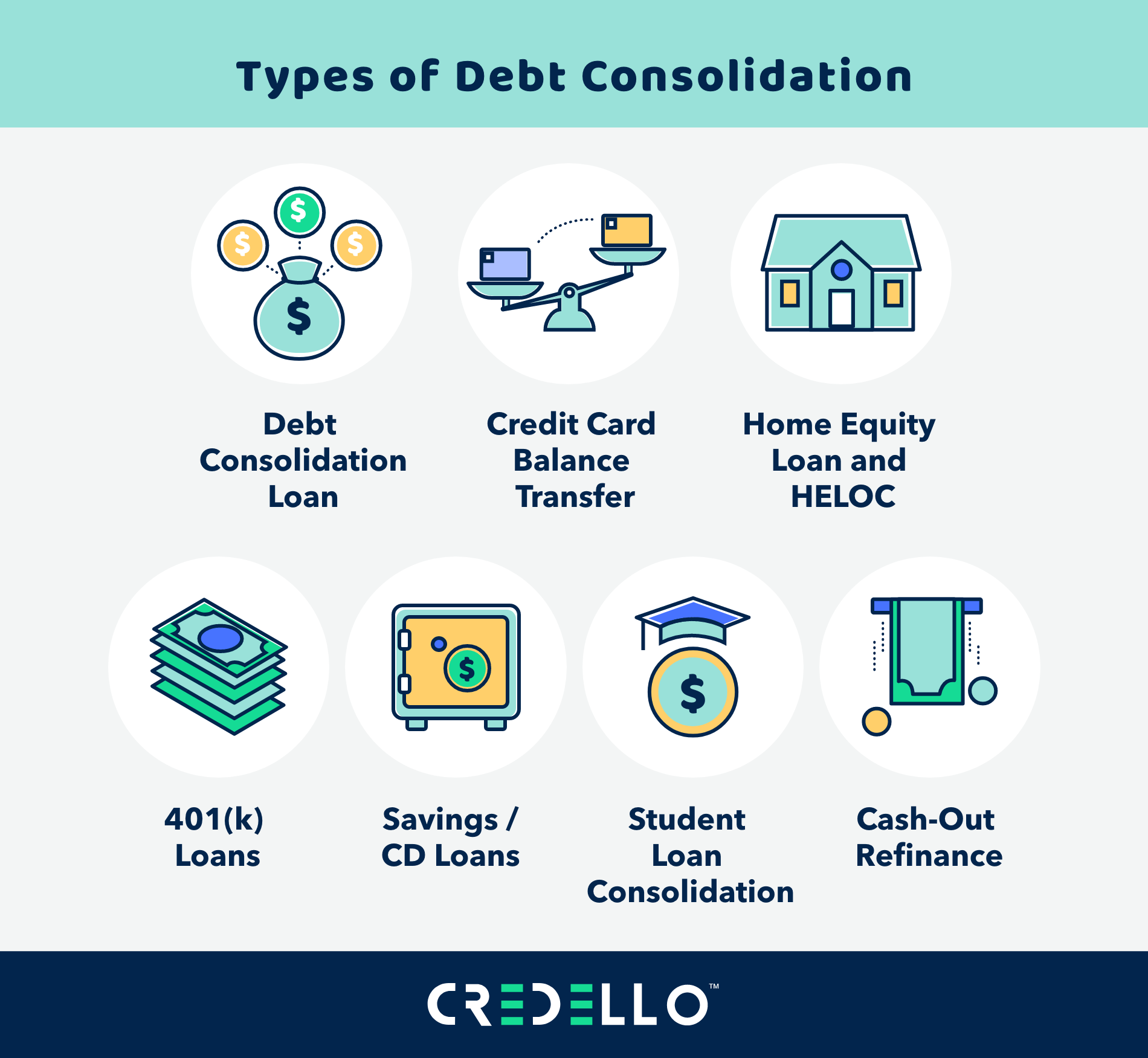

Types of Debt Consolidation

There are several types of debt consolidation to consider.

1. Debt Consolidation Loan

A debt consolidation loan is a lower interest personal loan that allows you to move multiple credit card balances or loans into one account. Since these loans are unsecured, they typically require a good credit score to receive the lowest interest rates.

Borrowers looking for a debt consolidation loan with bad credit may still be able to qualify, just for a slightly higher interest rate. That’s why it makes sense to shop around with various lenders to get the best price before committing.

Get the best debt consolidation options for your needs

We provide solutions you’re likely to get approved for.

2. Credit Card Balance Transfer

A credit card balance transfer makes sense for borrowers with good or excellent credit scores (above 690 on the FICO scale). That’s because these borrowers may qualify for a 0% APR credit card for a set period. And that period can be incredibly valuable in repaying debt without additional interest piling on.

But borrowers with poor credit may still find a balance transfer card useful. Streamlining multiple credit cards into a single payment makes sense as long as the interest rate on the new card is lower than the average of existing debts.

3. Home Equity Loan and HELOC

A home equity loan and home equity line of credit (HELOC) are secured loans where your home is the collateral. This means you’re borrowing money against the equity in your home, and that typically comes at a lower interest rate than other loan options.

Debt consolidation using a home equity loan can be a smart move when you have considerable equity in your home and are committed to repaying debt. However, those struggling with overspending could put their home at risk if the loan isn’t repaid timely.

4. 401(k) Loans

Typically, taking out a loan using a retirement account, like a 401(k), is a financial no-no. But in the case of debt consolidation, when you can commit to repaying the balance plus interest quickly, it may be worth a look.

401(k) loans generally have a low interest rate, plus you’ll be repaying the loan plus interest to yourself (less any fees from your 401(k) provider, of course). However, the major downside of taking a 401(k) loan is that it can derail your retirement savings plan. Add that to potential tax consequences and fees, and you’ll see that it’s probably best to review this loan option with a financial professional before you use a 401(k) loan for debt consolidation.

Related Article: Should You Use a 401k Loan to Pay Off Debt?

5. Savings / CD Loans

A Certificate of Deposit (CD) is a savings vehicle that you commit to leaving money in the account at a set interest rate for a specified period. You can, however, take out a CD loan against that money, whereas the CD acts as collateral to secure a personal loan.

Using a CD loan for debt consolidation is a way to leverage that money without facing early withdrawal penalties. But not all banks offer CD loans, and you have to have an active CD to qualify.

6. Student Loan Consolidation

Depending on the types of student loans you have, federal or private, the debt consolidation options look different. For example, you may lock in a longer repayment term for federal loans, which lowers monthly payments, but generally, you won’t receive a lower interest rate.

With private student loans, you can shop around to consolidate multiple loans into a single loan at a better interest rate. And that can result in pretty significant interest savings, especially if your loan balance is high.

7. Cash-Out Refinance

You can roll multiple debts into a cash-out refinance as another type of debt consolidation. With a cash-out refinance, you’ll replace your existing mortgage with one whose higher balance reflects the debt you’ve added on.

Since a cash-out refinance means taking out a new mortgage, there are closing costs and fees to consider. So you’ll need to calculate the interest savings from debt consolidation plus these costs before pursuing this option.

Is debt consolidation a good idea?

Debt consolidation is a good idea in several circumstances, such as when:

- You have great credit. Debt consolidation may be a good idea if your credit qualifies you for a 0% APR credit card or a lower-interest debt consolidation loan.

- You have a lot of debt. Typically, debt that can be repaid in less than a year may not be worth the cost or credit hit of taking out a debt consolidation loan.

- Your income is enough to cover monthly debt payments. If you’re struggling to meet debt payments, it may be best to pause on debt consolidation until you have more cash flow.

- You’re ready for a long-term financial change to avoid further debt. If you’ve taken steps to assess your financial picture and plan for a different future, you’re on the right track with debt consolidation. But those who haven’t yet committed to working toward a debt-free future could find themselves in more debt once a consolidation loan frees up credit cards.

Related Article:

Is Debt Consolidation a Good Idea?

Debt Consolidation Requirements

Certain requirements determine eligibility for debt consolidation. But it’s important to keep in mind that lenders’ debt consolidation requirements may vary, and specific lenders may have more lenient requirements than others.

- Reasonable, low-risk credit history and credit score

- Proof of income

- Proof of collateral (like your home) for large loans

- Low debt-to-income ratio (calculated by assessing your existing monthly debt payments divided by your monthly income)

How much can I save by consolidating my debts?

Savings will vary depending on what kind of debt you’re consolidating and how much the interest rate changes. You’ll also need to factor in any associated fees. Because this calculation can get pretty complex, it’s wise to use a debt consolidation calculator to determine how much you can save by consolidating debts.

Estimate your savings with our debt consolidation calculator

If you’re ready to explore how much you can save with debt consolidation, we’re here to help. Check out our debt consolidation calculator to see what you can save for free!

When debt consolidation is not a smart move?

Debt consolidation may not be a smart move for everyone. It’s smart to consult with a financial professional or explore other options if you:

- Haven’t yet changed the spending habits that got you into debt in the first place

- Have debt that can be repaid in less than a year

- Are working to improve a poor credit score

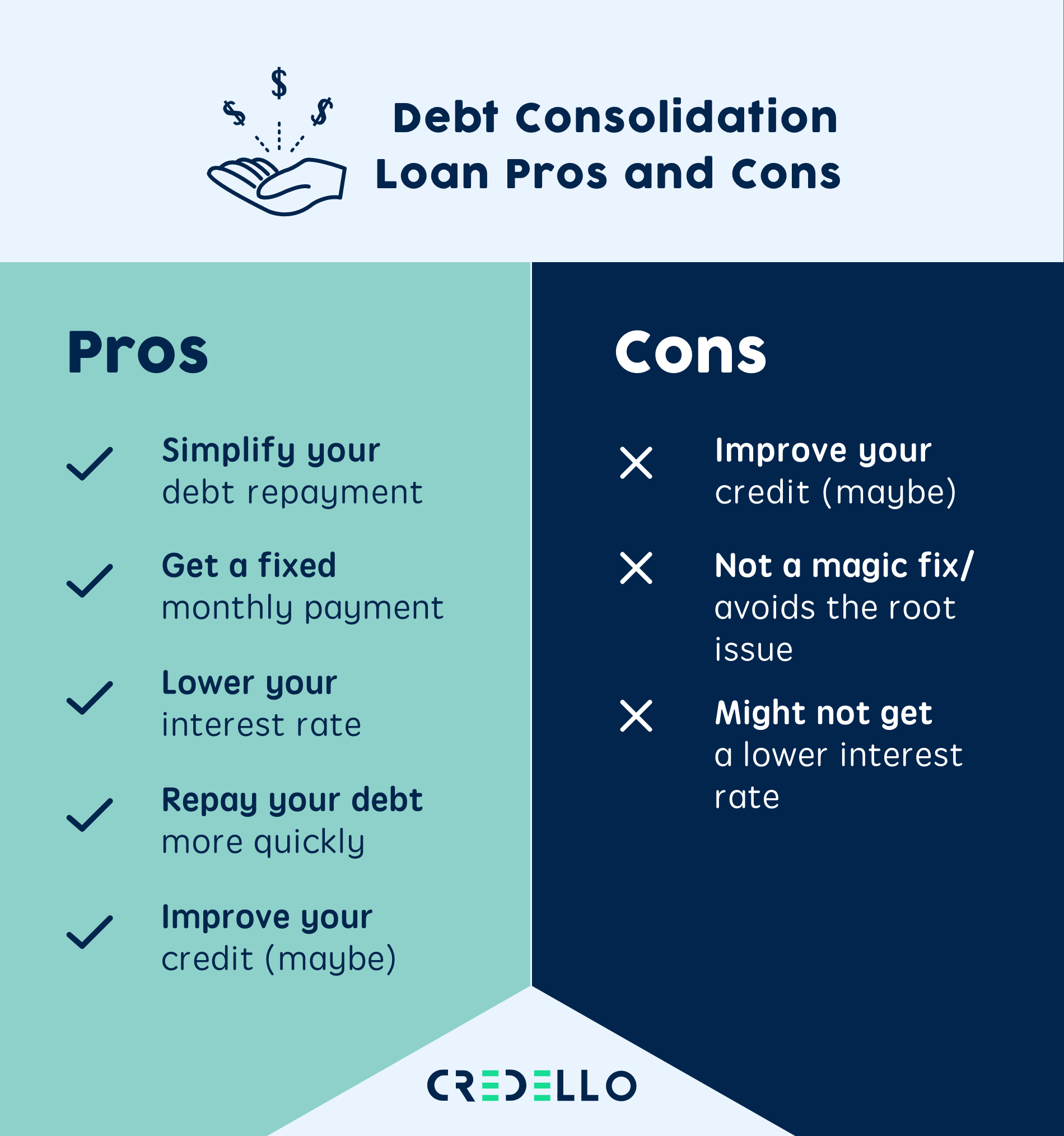

Debt consolidation pros and cons

As with any major financial decision, there are pros and cons of debt consolidation to be aware of before you commit. Pros of debt consolidation include:

- Potential to lower interest rates. Applicants with above-average credit scores have the most opportunity to lower interest rates by using a debt consolidation loan. But this could just as easily turn into a con for borrowers with poor credit who can’t consolidate into a better loan option.

- Simplifies the debt repayment process. For borrowers struggling to manage multiple debts, consolidating into a single debt is a major benefit of debt consolidation. One single monthly payment saves time, effort, and above all, it may help to eliminate late or missed payments.

- Could improve credit score. While borrowers may see a potential dip after applying for a new loan thanks to a hard credit check, ultimately, debt consolidation can improve credit scores. That happens through lowering credit utilization and increasing the likelihood of making timely payments.

But it’s essential to also be aware of the cons of debt consolidation:

- Fees can increase the loan cost. Lenders may enforce fees such as loan origination fees or balance transfer fees that can cut down debt consolidation savings. For this reason, it’s critical to understand the entire cost of the loan, fees included, before signing off.

- Debt consolidation loans can’t change behavior. Before committing to a debt consolidation loan, borrowers need to address the underlying habits that got them into debt in the first place. A chronic overspender could wind up back where they started if they don’t curb spending before consolidating debt.

Related Article: Is Debt Consolidation Good or Bad? Breaking Down the Pros and Cons of Debt Consolidation

How to choose the right debt consolidation company

Choosing the right debt consolidation company comes down to which type of debt consolidation you want to pursue. The characteristics of a great personal loan company may differ from those of a credit card company.

Regardless of which type of debt consolidation you choose, a great debt consolidation company will be reputable, legitimate, and have a proven track record of helping its customers with debt consolidation. You can verify a company’s legitimacy by looking at sites like the Better Business Bureau, checking online reviews, and making sure the company has a website that’s free from security issues and errors.

Debt Consolidation Alternatives

Debt consolidation can make sense in some circumstances, but there are alternatives to consider as well.

1. Debt Settlement

Debt settlement differs from debt consolidation in that you’ll work with a company that strives to close out debt with creditors for a fraction of what you owe. Typically debt settlement companies do this by not paying your bills, which can cause severe damage to your credit score.

2. Bankruptcy

Bankruptcy is typically a last resort for most people who are in debt. That’s because the recovery period from bankruptcy lasts years, and it effectively destroys your credit. So if you’re contemplating bankruptcy vs. debt consolidation, you’ll need to first consult with a lawyer or financial professional who can advise on the long-term repercussions.

3. Debt Management Plan

A debt management plan is handled by a credit counseling agency that helps you create an effective repayment plan for your debt. Your credit counselor may also be willing to reach out to creditors on your behalf to negotiate better interest rates and repayment terms. Typically, you will send a monthly payment to the debt management company, and they’ll distribute it to lenders accordingly.

Making the Most of Debt Consolidation

Debt consolidation is a useful financial tool for those who are struggling to manage multiple debts. The process of combining debts using a debt consolidation loan or balance transfer credit card can help you to simplify debt management. Combining debt consolidation with a well-thought-out repayment strategy means you’ll be on your way to debt freedom in no time.

Debt consolidation FAQs

Does debt consolidation really work?

Debt consolidation can work for those ready to commit to becoming debt-free and who have a credit score that enables them to qualify for a low-interest debt consolidation loan. But if someone hasn’t yet changed the behaviors that put them in debt in the first place, debt consolidation may not work.

Debt consolidation vs. Debt settlement: Which is better?

The process of debt settlement involves contacting creditors to settle a debt for less than what you owe. If you have the means to repay your debt in full, debt consolidation is an option that may be more beneficial to your credit score.

Related Article: Debt Settlement vs. Debt Management: Which Is Better for You?

Debt consolidation vs. Debt management: Which is better?

The goal of debt consolidation and debt management is similar: to help people get control of their debt. Debt consolidation may be better for those who can manage their loans and stay the course of repaying a single monthly debt. But those who feel overwhelmed by their debt or need to be held accountable to another person could find relief in a debt management program.

How to consolidate debt with bad credit?

Some companies offer debt consolidation loans for bad credit. To qualify, you may need to have a low debt-to-income ratio and established income. But to consolidate debt with the best interest rate, it may be best to take a few months to steadily repay debt and increase your credit score first.

Related Article: Debt Consolidation for Bad Credit

Do Debt Consolidation Loans Hurt Your Credit Score?

The hope is that debt consolidation loans will help your credit score over time. Initially, you may see a slight dip in your credit score due to the hard credit inquiry when you apply for the loan. But making on-time payments and reducing credit utilization may have positive impacts and help boost your score in the long term.

Related Article: Does Debt Consolidation Hurt Your Credit Score?

Does debt consolidation close credit cards?

Certain kinds of debt consolidation will close credit cards. For example, your cards may be closed if you’re consolidating using a debt management plan or debt consolidation loan. But if you’re using a balance transfer credit card or 401(k) loan to consolidate debt, your credit cards will not be closed, unless you choose to close them after paying them off.